Georgia Life Insurance Agent Exam Flashcards are a concise, portable study tool designed to simplify complex concepts. They cover essential topics, ensuring comprehensive preparation for the exam.

1.1 What Are Georgia Life Insurance Agent Exam Flashcards?

Georgia Life Insurance Agent Exam Flashcards are study tools designed to help aspiring agents master key insurance concepts efficiently. They consist of cards with questions or terms on one side and detailed explanations or answers on the other. These flashcards cover essential topics, from life insurance policies to Georgia-specific regulations, ensuring a focused and comprehensive study experience. Available in print or digital formats, they are a portable and interactive way to prepare for the exam, enabling agents to study anytime, anywhere, and retain complex information effectively.

1.2 Importance of Flashcards in Exam Preparation

Flashcards are a vital tool for efficiently mastering the Georgia Life Insurance Agent Exam material. They simplify complex concepts into digestible pieces, enabling active recall and spaced repetition, which enhance long-term retention. By breaking down information into concise questions and answers, flashcards allow focused study sessions and quick reviews. Their portability makes them ideal for on-the-go learning, ensuring consistent preparation. Regular use of flashcards boosts confidence and familiarity with exam topics, ultimately improving performance and helping aspiring agents achieve licensure.

Overview of the Georgia Life Insurance Agent Exam

The exam assesses knowledge of life insurance policies, health, and accident coverage, featuring multiple-choice questions and a section on Georgia insurance code, requiring a 70% passing score.

2.1 Exam Structure and Content

The Georgia Life Insurance Agent Exam features multiple-choice questions designed to test knowledge of insurance products, agent responsibilities, and state-specific regulations.

The exam includes sections on life insurance policies, health insurance, and accident coverage, with a dedicated portion focusing on Georgia insurance code.

Questions assess both factual knowledge and the ability to apply concepts in real-world scenarios, ensuring a comprehensive understanding of the material.

Understanding the exam’s structure and content is crucial for focused preparation, allowing candidates to prioritize key areas and effectively use study tools like flashcards.

2.2 Key Topics Covered in the Exam

The Georgia Life Insurance Agent Exam covers a wide range of topics, including life insurance policies, health insurance, and accident coverage.

It also delves into Georgia-specific insurance regulations and ethical considerations for agents.

The exam includes questions on policy types, riders, and annuities, as well as retirement planning concepts.

Key areas emphasize understanding insurance laws, agent responsibilities, and the application of insurance products in real-world scenarios.

Familiarizing oneself with these topics is essential for effective preparation and achieving a passing score on the exam.

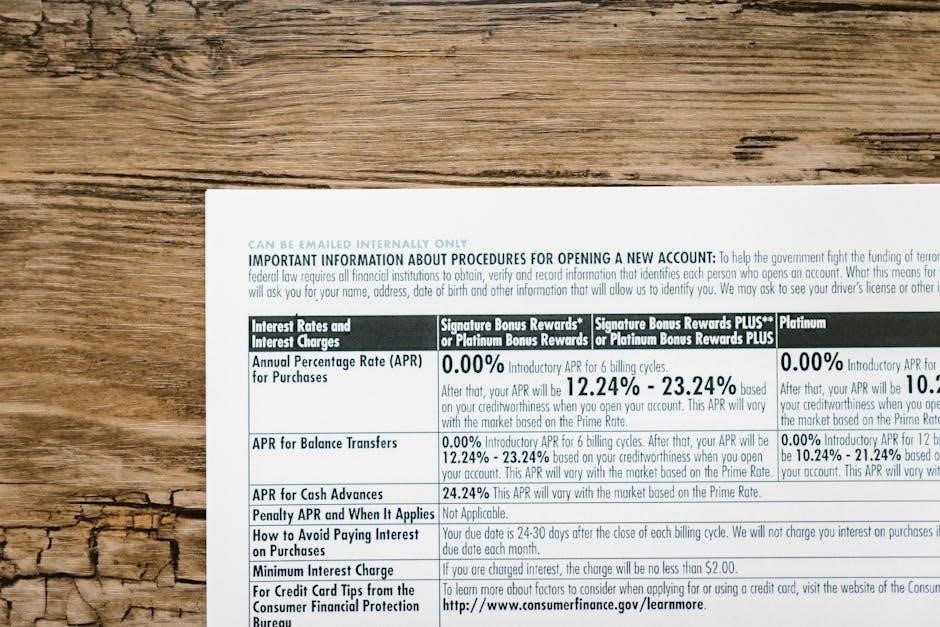

2.3 Scoring and Passing Requirements

The Georgia Life Insurance Agent Exam requires a passing score of 70%.

The exam consists of multiple-choice questions, with sections covering insurance products, agent responsibilities, and state-specific regulations.

Scoring is based on correct answers, with no penalties for incorrect responses.

Candidates must demonstrate a strong understanding of key concepts, including insurance laws and ethical practices.

Achieving the required score ensures eligibility for licensure as a life insurance agent in Georgia.

Understanding the scoring system and passing requirements is crucial for effective exam preparation and success.

The Role of Flashcards in Studying for the Exam

Flashcards simplify complex insurance concepts, enhancing retention and recall. They enable active learning and spaced repetition, making study sessions efficient and portable for exam preparation.

3.1 How Flashcards Simplify Complex Insurance Concepts

Flashcards break down intricate insurance ideas into digestible parts, making them easier to grasp. They focus on key terms and definitions, allowing learners to concentrate on essential concepts rather than overwhelming details. By isolating information, flashcards help users understand and retain complex topics like policy types, legal requirements, and ethical considerations. This method enables active recall, reinforcing memory and clarity. Additionally, visuals and colors on flashcards can highlight important points, further simplifying difficult material and aiding in long-term retention. This approach ensures learners master complex insurance concepts efficiently and effectively for the Georgia Life Insurance Agent Exam.

3.2 Benefits of Using Flashcards for Retention and Recall

Flashcards enhance retention by leveraging active recall, a powerful learning technique that strengthens memory. They allow learners to test themselves repeatedly, reinforcing key insurance concepts. Spaced repetition further improves long-term retention by reviewing material at optimal intervals. Flashcards also promote focused study, ensuring learners concentrate on essential information. Their portability enables anytime, anywhere review, making them ideal for consistent practice. Additionally, the use of visuals and colors on flashcards can enhance engagement and memory. Overall, flashcards are a highly effective tool for retaining and recalling complex insurance information, helping candidates prepare confidently for the Georgia Life Insurance Agent Exam;

Creating Effective Flashcards for the Exam

Effective flashcards focus on clear, concise information. Select key concepts, use simple language, and include visuals or colors to enhance learning. Ensure each card is informative yet straightforward.

4.1 Tips for Designing Clear and Concise Flashcards

When designing flashcards, prioritize clarity and conciseness. Start with a clear question or term on one side and provide a detailed yet straightforward answer on the other. Use bullet points or short sentences to avoid overcrowding. Incorporate visuals or colors to highlight key concepts and enhance retention. Ensure the information is relevant and aligned with the exam content. Avoid unnecessary details and focus on actionable insights. Regularly review and refine your flashcards to keep them updated and effective. This structured approach ensures your flashcards are both informative and easy to use for studying.

4.2 What to Include on Each Side of the Flashcard

Each side of the flashcard should serve a specific purpose. The front side should feature a clear question, term, or concept relevant to the Georgia Life Insurance Agent Exam. The back side should provide a concise yet comprehensive answer, including definitions, key explanations, and examples. For complex topics, break down information into digestible points. Include relevant statutes or regulations specific to Georgia. Avoid clutter by focusing on essential details that align with exam content. Ensure the information is accurate and up-to-date to maximize study effectiveness and retention.

4.3 Using Colors and Images to Enhance Learning

Using colors and images on flashcards can significantly enhance learning by making complex insurance concepts more engaging and memorable. Bright colors can highlight key terms or definitions, drawing attention to important details. Images, such as diagrams or charts, can visually explain intricate topics like policy types or coverage comparisons. This dual approach leverages the brain’s ability to process visual information more effectively, improving retention. Incorporating colors and images also breaks up text, making flashcards less overwhelming and more interactive. This visual enhancement not only boosts comprehension but also keeps study sessions engaging, helping aspiring agents master the material more efficiently.

Using Pre-Made Flashcard Resources

Pre-made flashcards are a convenient and efficient way to study for the Georgia Life Insurance Agent Exam. They are readily available online, covering essential topics like policies, laws, and ethics, and are designed to save time while ensuring comprehensive preparation.

5.1 Where to Find Reliable Flashcard Sets Online

Reliable flashcard sets for the Georgia Life Insurance Agent Exam can be found on official insurance education websites, such as those offering exam prep materials. Popular platforms like Kaplan, ExamFX, and XCEL also provide comprehensive flashcards tailored to the exam. Additionally, websites specializing in insurance exam preparation often offer downloadable PDF flashcards covering key topics like policies, regulations, and ethics. These resources are designed to align with the exam content and ensure candidates are well-prepared. Always verify the source and reviews to ensure the flashcards are up-to-date and relevant to the Georgia exam format.

5.2 Evaluating the Quality and Relevance of Pre-Made Flashcards

Evaluating pre-made flashcards for the Georgia Life Insurance Agent Exam involves ensuring they are accurate, relevant, and aligned with the exam content. Check if the flashcards cover Georgia-specific laws, policies, and ethical considerations. Verify that the information is up-to-date, reflecting current regulations and exam formats. Look for clear, concise questions and answers, avoiding overly complex or ambiguous content. Additionally, read reviews or testimonials from other users to gauge the flashcards’ effectiveness. Ensure the flashcards are free from errors and are organized logically to enhance study efficiency. This careful evaluation ensures you select high-quality resources tailored to your exam needs.

5.3 Popular Platforms for Insurance Exam Flashcards

Several platforms offer high-quality flashcards for the Georgia Life Insurance Agent Exam. Kaplan and Magoosh are popular choices, providing tailored content and advanced features like spaced repetition. Other platforms, such as ExamFX and XCEL, specialize in insurance exam prep, offering comprehensive flashcard sets. These resources often include Georgia-specific content, ensuring relevance. Many platforms also provide mobile access, allowing on-the-go study. When choosing, consider user reviews, content accuracy, and additional study tools like practice exams. These platforms are designed to enhance efficiency and effectiveness in preparing for the exam.

Effective Study Strategies with Flashcards

Flashcards enhance retention through active recall and spaced repetition. Regular review of key insurance concepts ensures mastery. This method is ideal for exam preparation and long-term retention.

6.1 Active Recall and Spaced Repetition Techniques

Active recall involves actively remembering information rather than passively re-reading it, enhancing memory retention. Flashcards leverage this by prompting users to recall concepts actively. Spaced repetition optimizes learning by reviewing content at increasing intervals, ensuring long-term retention. Together, these techniques help master complex insurance topics efficiently, making them ideal for exam preparation. Regular use of flashcards incorporating these methods strengthens understanding and recall of key insurance concepts, ensuring readiness for the Georgia Life Insurance Agent Exam.

6.2 Incorporating Flashcards into Your Study Schedule

Incorporating flashcards into your study schedule is essential for consistent and effective learning. Allocate specific times daily to review flashcards, focusing on key insurance concepts. Start with broad topics and gradually narrow to Georgia-specific regulations. Combine flashcards with other study tools, like practice exams, to reinforce understanding. Digital flashcards offer flexibility, while physical ones provide tactile learning. Consistency is key; regular reviews ensure retention and familiarity with exam material. By integrating flashcards into your routine, you can systematically cover all necessary topics, building confidence for the Georgia Life Insurance Agent Exam.

6.3 Group Studying with Flashcards

Group studying with flashcards enhances learning by making it interactive and engaging. Study groups allow you to quiz one another, fostering teamwork and motivation. Explaining concepts to others reinforces your own understanding, while hearing different perspectives enriches your knowledge. Flashcards can be used in games or competitions, adding fun to the process. Collaborative learning also helps identify gaps in knowledge and builds confidence. By sharing insights and strategies, group studying creates a supportive environment that complements individual study routines, ensuring a well-rounded preparation for the Georgia Life Insurance Agent Exam.

Understanding Georgia-Specific Insurance Regulations

Georgia-specific insurance regulations cover state laws, licensing requirements, and ethical standards; They ensure agents operate within legal frameworks, protecting consumers and maintaining industry integrity.

7.1 Overview of Georgia Insurance Laws

Georgia insurance laws regulate the industry to protect consumers and ensure fair practices. The state mandates licensing for agents, outlines ethical standards, and enforces consumer protection measures; These laws are enforced by the Georgia Office of Insurance and Safety Fire Commissioner, which oversees agent licensing, policy compliance, and dispute resolution. Key aspects include requirements for policy disclosures, claims processing, and agent conduct. The laws also address fraud prevention and penalties for non-compliance. Understanding these regulations is crucial for agents to operate legally and ethically within the state. They provide a framework for both industry professionals and policyholders, ensuring transparency and accountability.

7.2 Key Regulatory Agencies in Georgia

The primary regulatory agency overseeing insurance in Georgia is the Georgia Office of Insurance and Safety Fire Commissioner. This office is responsible for licensing insurance agents, enforcing state insurance laws, and ensuring compliance with regulatory requirements. It also handles consumer complaints and investigates fraud. Additionally, the Georgia Department of Insurance plays a role in overseeing insurance companies and ensuring they operate fairly and transparently. These agencies work together to maintain a stable insurance market and protect consumer interests. Their regulatory efforts ensure ethical practices and accountability within the insurance industry in Georgia.

7.3 Ethical Considerations for Insurance Agents in Georgia

Insurance agents in Georgia must adhere to strict ethical standards to maintain their licensure and public trust. This includes maintaining confidentiality of client information, avoiding conflicts of interest, and ensuring transparency in all transactions. Agents are required to act in the best interest of their clients, providing accurate and unbiased information. Misrepresentation or unethical practices can lead to penalties, fines, or even license revocation. Understanding and complying with Georgia-specific insurance laws and regulations is essential for ethical practice. Ethical behavior fosters professionalism and builds trust between agents and their clients, ensuring fair and honest insurance services in the state.

Mastering Key Insurance Concepts with Flashcards

Georgia Life Insurance Agent Exam Flashcards simplify complex concepts into digestible parts, aiding retention and understanding of essential insurance topics, policies, and riders for exam success.

8.1 Life Insurance Policies and Riders

Georgia Life Insurance Agent Exam Flashcards effectively break down complex life insurance policies and riders, simplifying terms like whole life, term life, and universal life. Riders, such as waiver of premium or accelerated death benefit, are clearly explained. Flashcards enable active recall, helping agents master policy types, features, and beneficiary designations. By focusing on key definitions and examples, flashcards ensure a deep understanding of life insurance products, making them easier to explain to clients and apply in real-world scenarios. This focused study approach enhances retention and confidence for the exam and beyond.

8.2 Health Insurance and Accident Coverage

Georgia Life Insurance Agent Exam Flashcards simplify complex health insurance and accident coverage concepts, focusing on key terms and policies. Flashcards cover major medical plans, short-term health insurance, and accident benefits, ensuring a clear understanding of coverage types and limitations. By breaking down intricate details into digestible pieces, flashcards enhance active recall and retention. They also highlight how accident coverage integrates with health insurance, providing a comprehensive view of policy structures and beneficiary protections. This targeted approach helps agents confidently master health-related insurance topics, ensuring exam success and practical application in real-world scenarios.

8.3 Annuities and Retirement Planning

Annuities and retirement planning are critical components of life insurance studies. Flashcards simplify complex annuity types, such as fixed, variable, and indexed annuities, and their roles in retirement strategies. They highlight how annuities provide guaranteed income streams, tax benefits, and legacy planning options. By focusing on key features and beneficiary options, flashcards help agents understand annuity structures and how they align with client goals. This section ensures mastery of retirement planning tools, enabling agents to confidently advise clients on securing financial stability and long-term income solutions. Flashcards make intricate annuity details accessible and easy to retain.

Final Exam Preparation Tips

Organize your final review, manage test anxiety with deep breathing, and ensure all essentials like ID and materials are ready for exam day.

9.1 Organizing Your Final Review

Organizing your final review involves creating a structured plan to cover all key topics efficiently. Use active recall by making flashcards and writing summaries of complex concepts. Focus on weak areas identified during practice exams. Prioritize reviewing comprehensive insurance coverage and Georgia-specific regulations. Schedule regular breaks to maintain focus and avoid burnout. Ensure all study materials, like notes and practice questions, are well-organized. This systematic approach ensures you cover everything without feeling overwhelmed, helping you enter the exam with confidence and readiness.

9.2 Managing Test Anxiety and Staying Focused

Managing test anxiety is crucial for optimal performance. Techniques like deep breathing exercises and positive self-talk can help calm nerves. Visualization of success and reminding yourself of preparation efforts boosts confidence. Staying focused involves eliminating distractions and maintaining a positive mindset. A consistent study routine and adequate rest before the exam are essential. Prioritize self-care to ensure mental clarity. By addressing anxiety proactively, you can approach the exam with confidence and maintain focus throughout, ensuring you perform at your best and demonstrate your knowledge effectively.

9.3 Exam Day Essentials and Checklist

To ensure a smooth exam experience, gather all necessary items in advance. Bring a valid government-issued ID, your exam confirmation, and any permitted materials like pens and a calculator. Arrive early to account for check-in and security procedures. Dress comfortably and stay hydrated with water and light snacks. Charge your devices if electronic materials are allowed. Review the exam rules to avoid last-minute issues. Organize your checklist the night before to avoid morning stress. Feeling prepared will help you stay calm and focused, ensuring you can demonstrate your knowledge effectively during the exam.

Georgia Life Insurance Agent Exam Flashcards are an indispensable tool for success. They streamline complex concepts, enhance retention, and build confidence, ensuring aspiring agents are well-prepared for licensure.

10.1 The Impact of Flashcards on Exam Success

Georgia Life Insurance Agent Exam Flashcards significantly enhance exam success by simplifying complex concepts and improving retention. They allow for active recall and spaced repetition, which strengthen memory and understanding. By breaking down information into digestible pieces, flashcards make studying efficient and portable. Their concise format ensures focused learning, helping candidates master key topics like insurance policies and state-specific regulations. Regular use of flashcards builds confidence and reduces exam anxiety, ultimately leading to higher success rates. They are a proven, effective tool for achieving licensure and excelling in the insurance field.

10.2 Final Thoughts on Becoming a Licensed Agent

Becoming a licensed Georgia life insurance agent is a rewarding milestone, requiring dedication and thorough preparation. Flashcards play a pivotal role in simplifying complex concepts, ensuring confidence and readiness for the exam. By mastering insurance principles, ethics, and state-specific regulations, aspiring agents can provide valuable guidance to clients. The journey to licensure not only enhances professional skills but also opens doors to a fulfilling career in the insurance industry. With persistence and the right tools, future agents can achieve success and make a meaningful impact in helping others secure their financial futures.